If you’re a bit on the older side, you might have received a paper Series E savings bond as a gift from a grandparent or other relative. In fact, you might still have a few of those Series E bonds sitting in a safe or drawer somewhere, collecting dust. Now might be the time to dust off those paper bonds and cash them in. After all, Series E savings bonds were replaced by Series EE savings bonds in 1980 and they probably aren’t earning interest anymore.

What are Series E savings bonds worth?

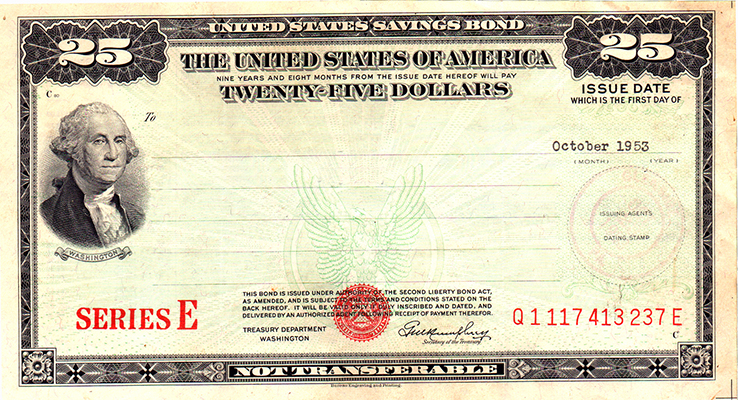

The worth of your Series E savings bonds depends on their face value and how long they were earning interest. Our relatives probably liked paper bonds because they were issued at a discount, meaning the price paid was less than the face value at maturity. Series E bonds issued after November 1965 earned interest for 30 years. When you cash your bond, it’s worth the face value, plus any interest accrued, based on the rates prevalent when the bond was purchased. You can check the value of your savings bonds online at TreasuryDirect.gov. In order to ascertain the value, you need to know:

• the series,

• the denomination,

• the serial number, and

• the issue date.

With that information, you can get an idea of what your bonds are worth.

When should I cash in Series E savings bonds?

Because the last Series E savings bond stopped earning interest in 2010, it is suggested that you cash them in if you have them, although you don’t have to do that. In some cases, having those savings bonds can provide comfort as a way of making sure there’s something available in an emergency. On the other hand, though, you might be better off cashing in your Series E bonds and putting that money to work in something likely to provide a return. There are much better ways to invest your money. It can make sense to cash in your bonds if you need the money or think you can find a bond that pays a higher interest rate.

How to cash in paper Series E savings bonds

Because Series E savings bonds are in paper format, the easiest way to cash them in is to bring them to your financial institution. Your bank or credit union can use information about when the bonds were issued and the interest rate at the time to calculate the value and provide you with the money you’re entitled to. Once you’ve cashed in your savings bonds, you can use the money to meet your current needs, or invest the money in Series EE savings bonds or other investments, including stocks and other bonds, that might offer a better return.

Are Series E savings bonds worth it?

Right now, it’s not possible to purchase new Series E savings bonds. Instead, if you want to invest in Treasury savings bonds in the E series, the next option is to purchase Series EE savings bonds electronically through TreasuryDirect.gov. There are some pros and cons of adding Series EE savings bonds to your portfolio.

Pros

• Interest earnings are tax-free when used for education.

• They make great gifts for children or grandchildren.

• Series EE bonds are guaranteed to pay out double their face value after 20 years.

Cons

• Interest rates are low, so bonds bought now won’t see high returns.

• They likely won’t keep up with inflation.

Bottom line

While you can’t buy Series E bonds anymore, if you have them sitting in a drawer somewhere, it can make sense to cash them in since they’re no longer earning interest. Adding Series EE savings bonds to your portfolio can provide you with some stability, and offer you the chance to see guaranteed returns, especially if you keep the bonds for at least 20 years. However, you might be better off with something else. When constructing a theoretical portfolio, it’s difficult to find a reason to buy Series EE bonds; instead, it might make more sense to simply make the bond allocation among a few bond funds.