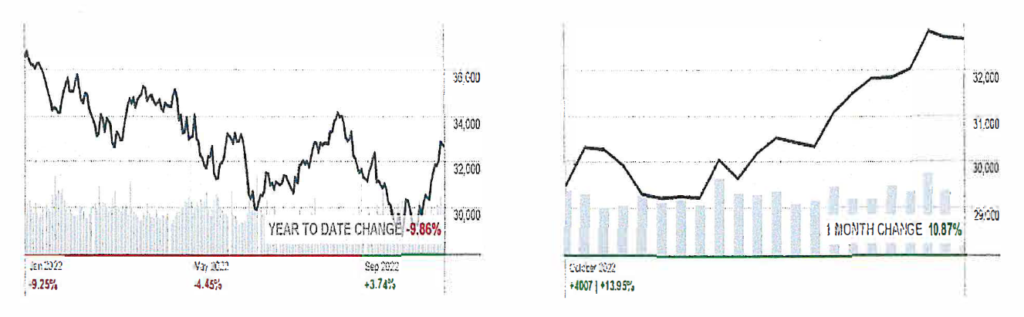

As we approach the midterm elections, the U.S. Federal Reserve (Fed) continues to raise interest rates with another increase of 75 basis points expected this week. Credit and interest rate markets have adjusted to this Fed action and the impact of monetary policy on future economic growth. Additionally, with a surprising degree of consistency over the past 100 years or so, stocks have followed a broad pattern that coincides with presidential terms. The months leading up to midterm elections have generally been the worst in what is known as the four-year presidential election cycle. Currently, the market is down 9.86% year-to-date.

But in the last 30 days, it has gained 10.87%! Stocks have usually rallied in the year after the midterms—no matter which side wins. We have built diversification into our portfolios and will look to take advantage of opportunities as we see fit. As always, we have your best interests at heart!

Sincerely,

Kent C. Newhart, President

Michael P. Boyko

Michael P. Boyko, Senior Account Executive