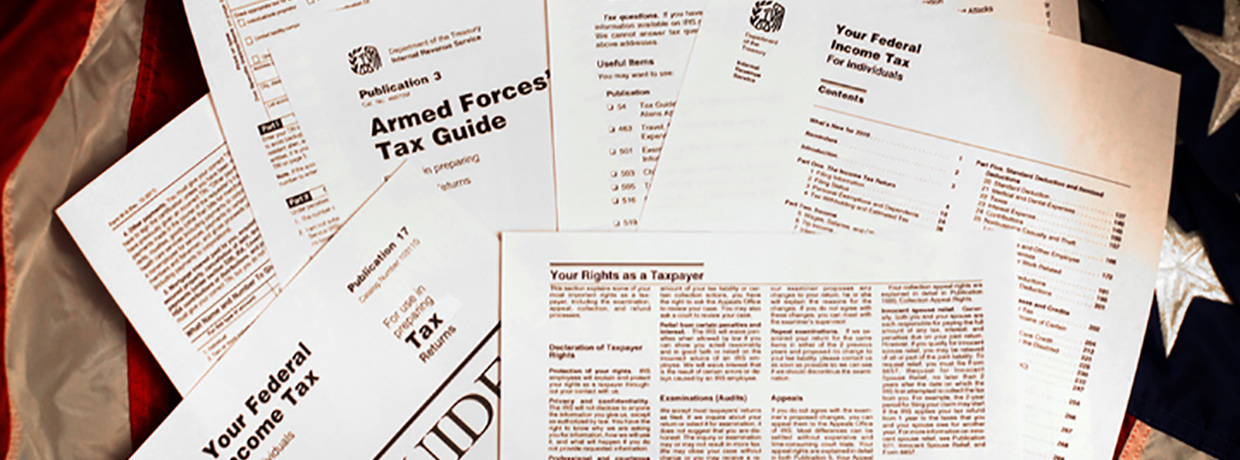

If you're like many people at tax time, you find yourself with drawers full of receipts, statements, and old tax forms, afraid that the IRS will come to get you 20 years from now. But now is the time to start the spring cleanup of your files! Jill Schlesinger of "Jill On Money" offers tips, some surprising, all wise, on what to save and what to shred.

IRS Tax Tip 2022-183, November 30, 2022 Wading through a pile of statements, receipts, and other financial documents when it's time to prepare a tax return can be frustrating for people who haven't managed their records. By knowing what they need to keep and how long to keep…

Organized tax records make preparing a complete and accurate tax return easier and may help taxpayers find overlooked deductions or credits.