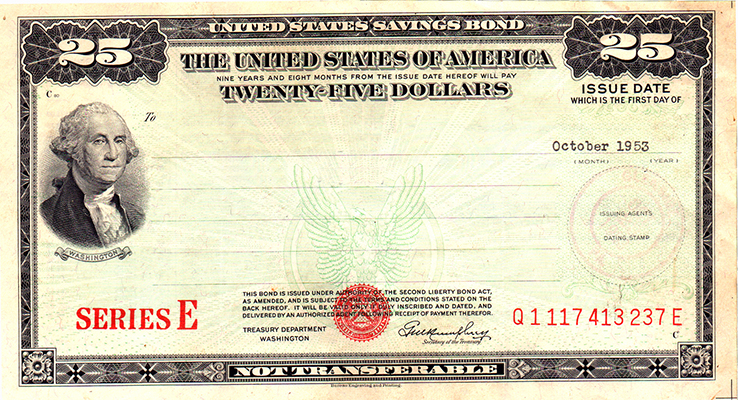

If you're a bit on the older side, you might have received a paper Series E savings bond as a gift from a grandparent or other relative. In fact, you might still have a few of those Series E bonds sitting in a safe or drawer somewhere, collecting…

Remember, the IRS never sends you emails regarding your tax refund. Scammers often pose as the IRS and send emails to taxpayers, asking for information "before their tax refund can be processed." The emails may appear legitimate and even say "From: IRS” or use their logo. But even…

Many taxpayers have experienced slower than anticipated IRS tax refund processing speed or time in 2021. If your status shows that your information entered was incorrect when you are certain you have entered the right data, this may be due to these delays, meaning they do not have a record of the…

WASHINGTON — The Internal Revenue Service today reminds taxpayers about the upcoming October 15 due date to file 2020 tax returns. People who asked for an extension should file on or before the extension deadline to avoid the penalty for filing late. Electronic filing options, such as IRS…

ATA Financial recently built an addition to our property in Whitehall to suit our need for a place to grow, providing a more convenient facility for our clients. The addition includes a new conference room and more office space, plus a new lighted sign for better visibility. Outside,…

https://vimeo.com/198737779 Lehigh Valley Business interviews Kent Newhart, President of ATA Financial (January 9, 2017) Lehigh Valley Business: How long has ATA Financial Group LLC been operating in the region, and what are its primary services? Kent Newhart: Our core business was started as Accounting & Tax Associates in October…

Have you been shopping at your local businesses? Here are three reasons to stay local! 1. Community well-being Locally-owned businesses help build strong communities by linking neighbors of different backgrounds together. They build economic and social relationships within the community while also supporting local causes! 2. Keeping your money in the…

Scammers are becoming more and more sophisticated with their ways to steal money or personal information. Now that we are in the midst of tax season, it is important to protect yourself from scammers. If you receive a call from a person claiming to be from the Internal…

Despite the government shutdown, the Internal Revenue Service confirmed that it will process tax returns beginning January 28, 2019 and provide refunds to taxpayers as scheduled."We are committed to ensuring that taxpayers receive their refunds notwithstanding the government shutdown. I appreciate the hard work of the employees and their commitment…

Expecting a refund? Most filers can expect a refund check to be issued within 21 days of the IRS receiving a return. However, it's possible your tax return may require more review and take longer. The IRS website offers a valuable tool to check on the status of…