Strong equity returns typically emerge after consumer confidence slumps.

Investors in both the stock and the bond markets are understandably nervous. In late September, Burton Malkiel wrote a column in The Wall Street Journal with sound advice for investors both years away from retirement and in retirement. https://tribunecontentagency.com/article/the-savings-game-dont-give-up-on-the-stock-market/

Many workers aren’t ready to retire at the traditional retirement age of 65 and instead continue working into their 70s. While they can postpone retirement, they can’t entirely delay taking required minimum distributions (RMDs) from tax-deferred retirement accounts. If you’re working into your 70s, here’s what you need…

Stubbornly high inflation has prompted the U. S. Federal Reserve (Fed) to raise interest rates at the fastest pace in decades. Credit and interest rate markets are working to adjust their expectations for Fed action and the impact of monetary policy on future economic growth.

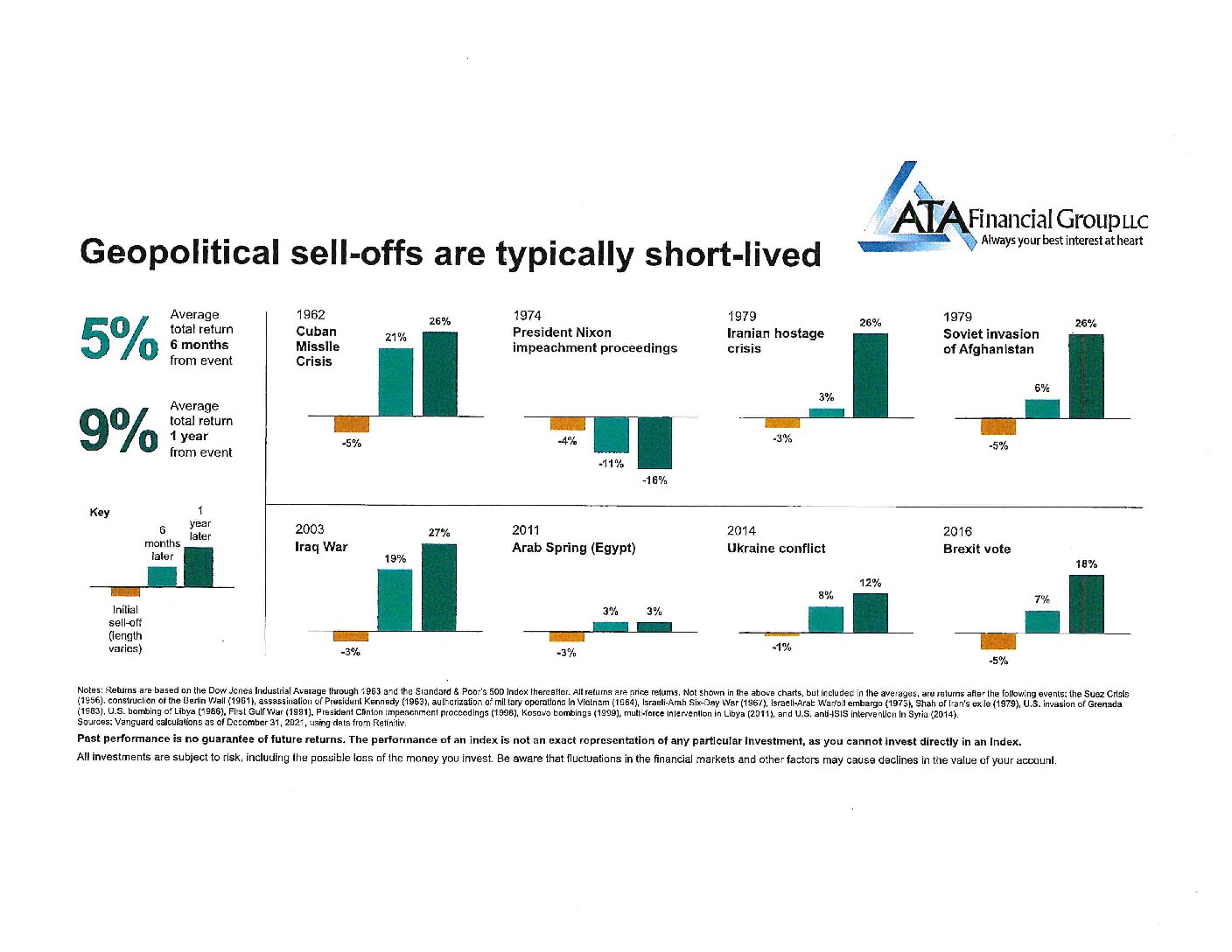

In light of recent geopolitical developments in Ukraine and their effects on the market, you may be concerned about your investments. Rest assured that we are in tune with market conditions and don’t let our emotions lead to poor decisions.

Whether you are a beginner or experienced investor, here at ATA Financial Group, we can provide you with insight and guidance based on an understanding of your unique situation. We offer a complimentary no-obligation financial review. In our meeting, we will go through 6 steps: Identify your goals and the level…

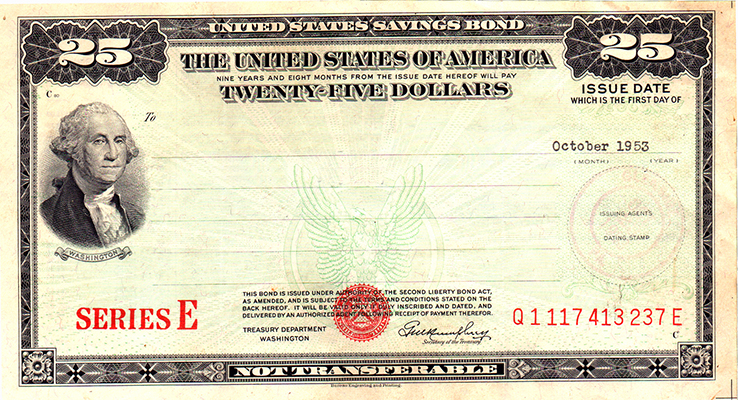

If you're a bit on the older side, you might have received a paper Series E savings bond as a gift from a grandparent or other relative. In fact, you might still have a few of those Series E bonds sitting in a safe or drawer somewhere, collecting…