Each of us will die. Even though we know this, most find that planning for death is not easy. Preparing for the inevitable, whether close at hand or in the indeterminate future, can help your family through the difficult process of death and its aftermath. Much has been…

Investors in both the stock and the bond markets are understandably nervous. In late September, Burton Malkiel wrote a column in The Wall Street Journal with sound advice for investors both years away from retirement and in retirement. https://tribunecontentagency.com/article/the-savings-game-dont-give-up-on-the-stock-market/

As a general rule, debt cancellation income is taxable. But a 2021 law provides that most student loans forgiven from 2021 through 2025 are tax-free. Read more from Kiplinger's Money Power. https://tribunecontentagency.com/article/ask-kip-will-the-irs-tax-forgiven-student-loans/

Social security benefit amounts depend upon many factors. Before applying for benefits, there are many questions to be answered. Elliot Raphaelson of The Savings Game answers some of the more common questions. https://tribunecontentagency.com/article/the-savings-game-social-security-income-restrictions/

Stubbornly high inflation has prompted the U. S. Federal Reserve (Fed) to raise interest rates at the fastest pace in decades. Credit and interest rate markets are working to adjust their expectations for Fed action and the impact of monetary policy on future economic growth.

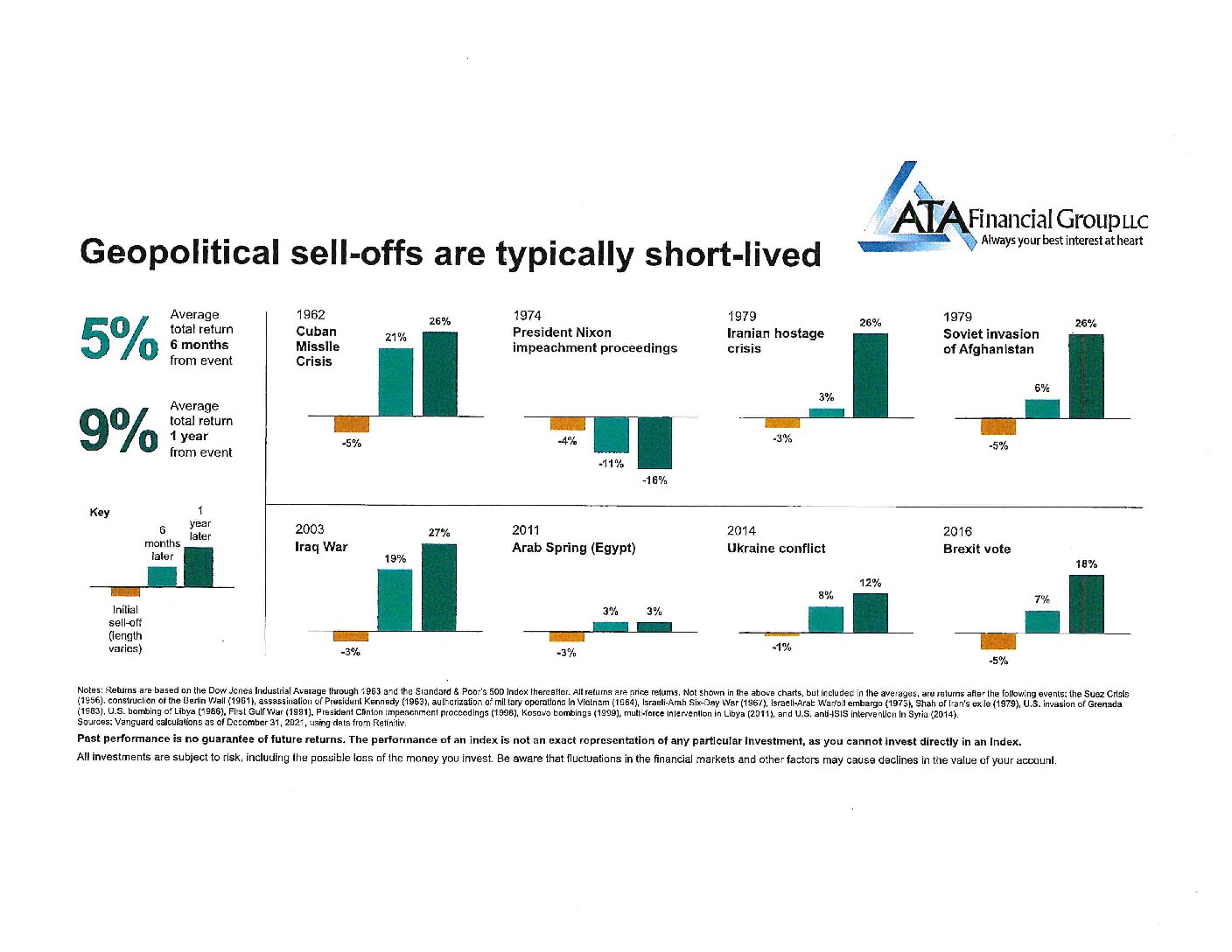

In light of recent geopolitical developments in Ukraine and their effects on the market, you may be concerned about your investments. Rest assured that we are in tune with market conditions and don’t let our emotions lead to poor decisions.

Organized tax records make preparing a complete and accurate tax return easier and may help taxpayers find overlooked deductions or credits.

Whether you are a beginner or experienced investor, here at ATA Financial Group, we can provide you with insight and guidance based on an understanding of your unique situation. We offer a complimentary no-obligation financial review. In our meeting, we will go through 6 steps: Identify your goals and the level…

Depreciation is an annual tax deduction that allows small businesses to recover the cost or other basis of certain property over the time they use the property. It is an allowance for the wear and tear, deterioration, or obsolescence of the property. Small businesses can depreciate property when…