The Social Security Administration is celebrating passage of the One Big, Beautiful Bill, that delivers long-awaited tax relief to millions of older Americans.

529 plans are an excellent tool for saving for college. Learn how they interact with financial aid calculations and plan to help optimize financial aid outcomes.

One of the positive features of the SECURE Act, passed in 2019, was that it eliminated the restriction that if you had reached age 70 1/2, you could no longer make IRA contributions.

If you are the owner of an IRA account or a beneficiary, you need to understand the rules governing when to take required minimum distributions (RMDs). Regulations have changed regarding penalties for missed RMDs. Although the penalties starting in 2023 have been reduced, the amounts can still be very significant.

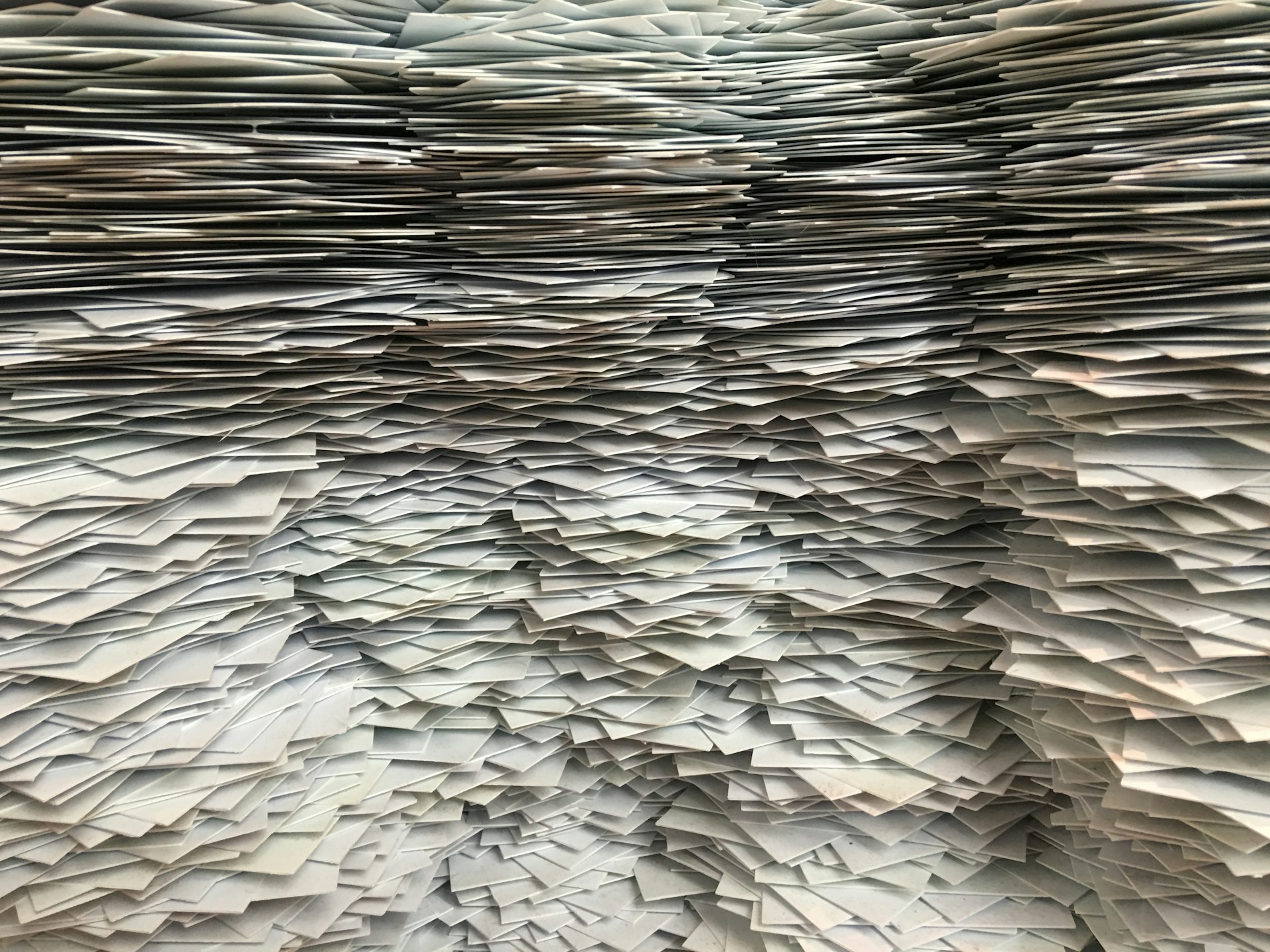

If you're like many people at tax time, you find yourself with drawers full of receipts, statements, and old tax forms, afraid that the IRS will come to get you 20 years from now. But now is the time to start the spring cleanup of your files! Jill Schlesinger of "Jill On Money" offers tips, some surprising, all wise, on what to save and what to shred.

Receiving a tax refund is exciting as long as you don't dwell on the fact that it was your money to begin with! Jill Schlesinger of "Jill on Money" shares tips on reducing your withholding if possible and using your tax refund wisely.

Retirement may seem a long way off, but it's important to plan for the retirement you desire.

Building off the success of the 2023 tax season that saw significant improvements following passage of the Inflation Reduction Act, the 2024 filing season will continue reflecting the focus on improving services to taxpayers.

Confused about Social Security and IRA benefits under certain life circumstances? Find answers from The Savings Game.

Retirees are surprised to dind as much as 85% of their Social Security benefits could be taxable., depenings on their amount of provisional income, which includes half of their Social Security benefits plus other sources that contribute to adjusted gross income (AGI), such as wages, dividends, and capital gains.