529 plans are an excellent tool for saving for college. Learn how they interact with financial aid calculations and plan to help optimize financial aid outcomes.

One of the positive features of the SECURE Act, passed in 2019, was that it eliminated the restriction that if you had reached age 70 1/2, you could no longer make IRA contributions.

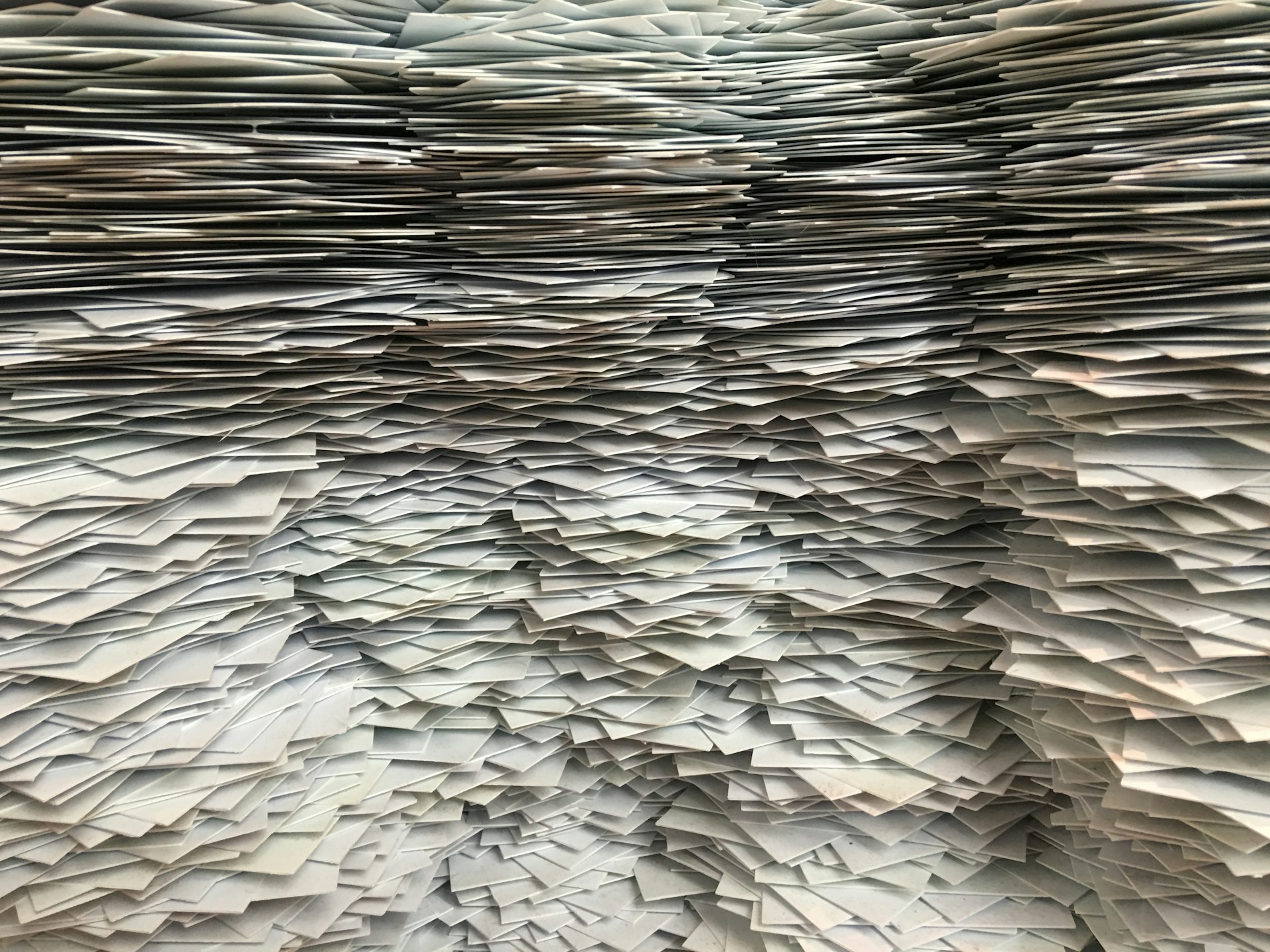

If you're like many people at tax time, you find yourself with drawers full of receipts, statements, and old tax forms, afraid that the IRS will come to get you 20 years from now. But now is the time to start the spring cleanup of your files! Jill Schlesinger of "Jill On Money" offers tips, some surprising, all wise, on what to save and what to shred.

Retirement may seem a long way off, but it's important to plan for the retirement you desire.

If you want to succeed in financial planning, you need to use the best-informed, up-to-date, and unbiased sources. Elliot Raphaelson shares his recommendations.

Building off the success of the 2023 tax season that saw significant improvements following passage of the Inflation Reduction Act, the 2024 filing season will continue reflecting the focus on improving services to taxpayers.

Read Terry Savage's article to discover ways to invest your "chicken money" for the best return.

Confused about Social Security and IRA benefits under certain life circumstances? Find answers from The Savings Game.

Retirees are surprised to dind as much as 85% of their Social Security benefits could be taxable., depenings on their amount of provisional income, which includes half of their Social Security benefits plus other sources that contribute to adjusted gross income (AGI), such as wages, dividends, and capital gains.

Schwab and TD Ameritrade continue to make great progress on the integration of the two firms, with an anticipated transition date of September 5, 2023.